The platform that unifies your financial and commercial management

As the principal product designer for the Nexxera Group, my role was pivotal in shaping the user experience of a comprehensive financial and mercantile management ecosystem. I was responsible for translating the platform's strategic goals of unifying financial and mercantile operations, centralising stakeholders, and improving efficiency into intuitive and user-friendly digital interfaces and experiences. My expertise in UX and user research proved crucial as I worked to understand the complexities of the existing processes and design solutions that met the needs of various users, including internal teams and external partners such as suppliers.

My Role

As a Product Designer, I was responsible for:

• User flows and journey maps: I visualised how different users would interact with the platform to achieve their goals, ensuring smooth and efficient processes.

• Information architecture: I defined the structure and organisation of the platform's content and features to enable easy navigation and understanding.

• Wireframes and prototypes: I created representations of the user interface to test and iterate on design solutions.

• User interface (UI) design: I developed the visual style and components of the platform, ensuring consistency and usability.

• Usability testing reports: I gathered feedback from users on the design and identified areas for improvement.

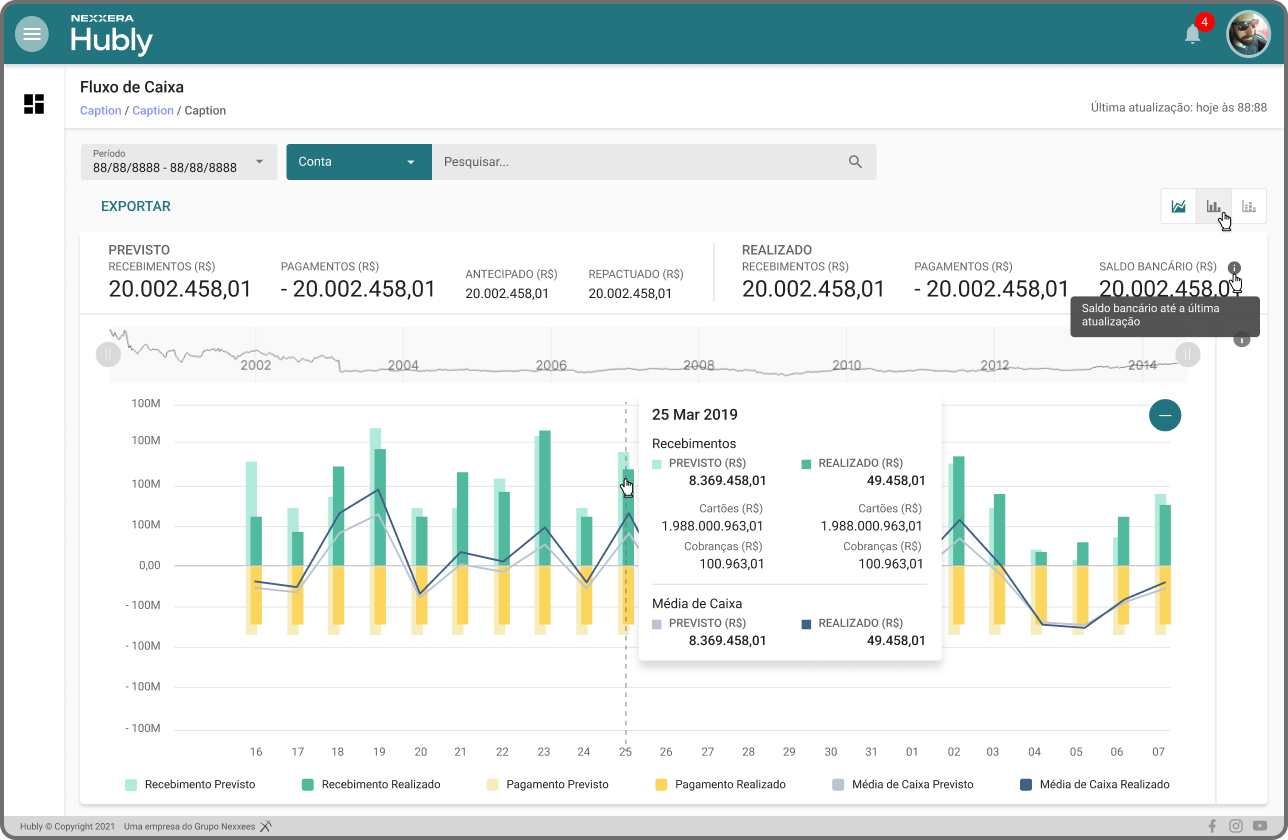

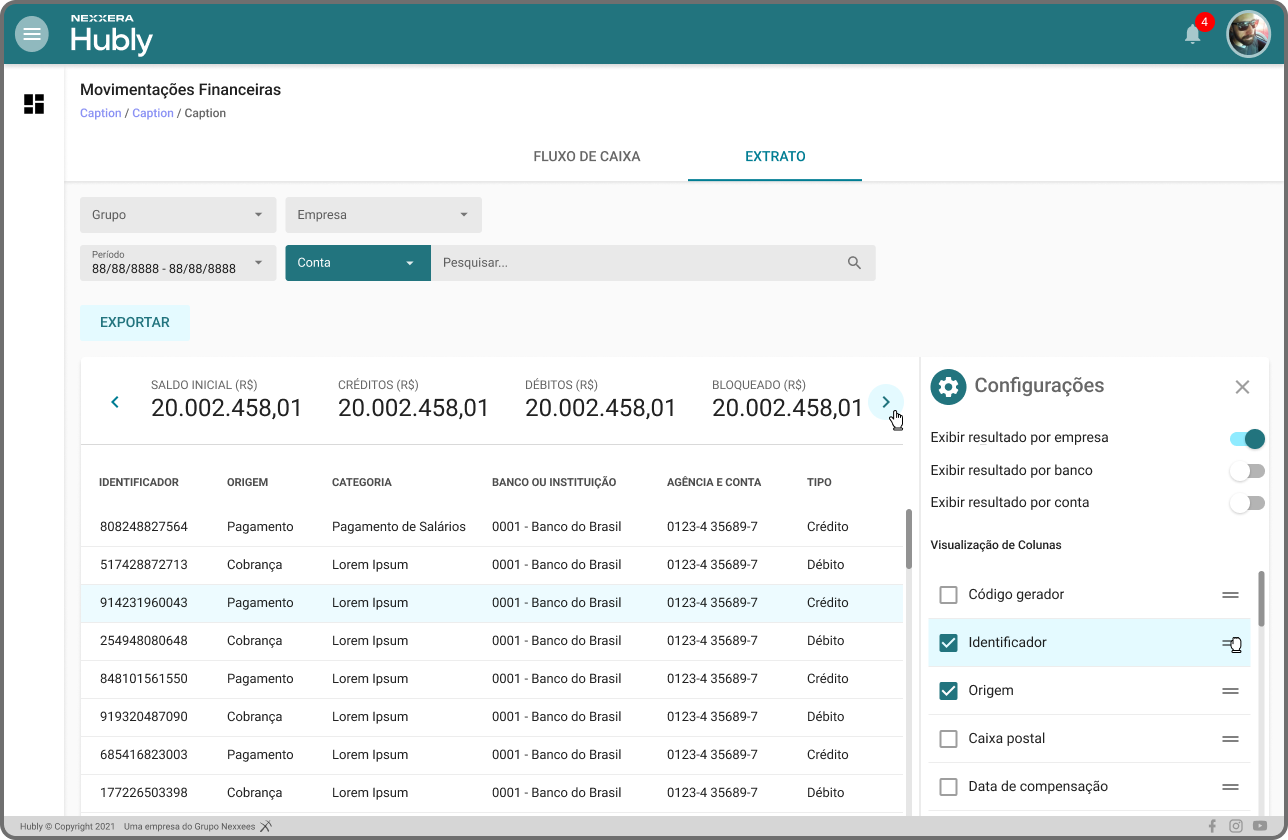

• Dashboards and reporting interfaces: I designed clear and customisable ways for users to visualise financial and operational data.

• User research insights: These were based on my analysis of user needs and pain points in financial and mercantile management for both internal teams and external partners (suppliers, clients, and financial institutions).

As a Product Designer, I was responsible for:

• User flows and journey maps: I visualised how different users would interact with the platform to achieve their goals, ensuring smooth and efficient processes.

• Information architecture: I defined the structure and organisation of the platform's content and features to enable easy navigation and understanding.

• Wireframes and prototypes: I created representations of the user interface to test and iterate on design solutions.

• User interface (UI) design: I developed the visual style and components of the platform, ensuring consistency and usability.

• Usability testing reports: I gathered feedback from users on the design and identified areas for improvement.

• Dashboards and reporting interfaces: I designed clear and customisable ways for users to visualise financial and operational data.

• User research insights: These were based on my analysis of user needs and pain points in financial and mercantile management for both internal teams and external partners (suppliers, clients, and financial institutions).

Summary

The development of Nexxera Hubly aimed to solve the problem of fragmented and inefficient financial and mercantile management within business ecosystems. Organizations often struggle with managing numerous suppliers, handling complex payment and collection processes across multiple banks and systems, and gaining a unified view of their financial health. This complexity leads to manual errors, increased operational costs, and difficulties in optimizing cash flow and supplier relationships. This solution seeks to address these issues by providing a centralized platform that unifies processes, automates workflows, and enhances visibility for all participants.

The Challenge

Several challenges related to the environment and ecosystem are inherent in this project:

• Complexity of integrating diverse systems: The platform aims to integrate with over 200 ERPs and numerous financial institutions. Ensuring seamless and reliable data exchange across these varied systems (using standards like CNAB) and providing clear guidance to users during this integration will be a significant challenge.

• Managing multiple stakeholders with different needs: The ecosystem includes internal finance, procurement, and logistics teams, as well as external suppliers and potentially clients. Understanding and designing for the diverse needs and technical proficiencies of these user groups will be crucial.

• Ensuring data security and privacy: Handling sensitive financial and business data across numerous connections requires robust security measures and adherence to privacy policies. The design must build trust and provide transparency regarding data handling.

• Facilitating adoption by suppliers: Suppliers need to adopt the platform to realise its full potential for the buyer. Designing a user-friendly and valuable experience for suppliers, including clear onboarding and potentially subsidised costs, will be critical for ecosystem success.

• Handling the complexity of financial transactions: Managing payments, collections, credit, and card reconciliations across multiple banks and currencies introduces inherent complexity that needs to be simplified through the user interface.

• Maintaining platform stability and reliability: With a high volume of transactions, ensuring the platform's stability (mentioned as a 99.7% stability index) and providing reliable performance is paramount for user trust and business continuity.

• Managing multiple stakeholders with different needs: The ecosystem includes internal finance, procurement, and logistics teams, as well as external suppliers and potentially clients. Understanding and designing for the diverse needs and technical proficiencies of these user groups will be crucial.

• Ensuring data security and privacy: Handling sensitive financial and business data across numerous connections requires robust security measures and adherence to privacy policies. The design must build trust and provide transparency regarding data handling.

• Facilitating adoption by suppliers: Suppliers need to adopt the platform to realise its full potential for the buyer. Designing a user-friendly and valuable experience for suppliers, including clear onboarding and potentially subsidised costs, will be critical for ecosystem success.

• Handling the complexity of financial transactions: Managing payments, collections, credit, and card reconciliations across multiple banks and currencies introduces inherent complexity that needs to be simplified through the user interface.

• Maintaining platform stability and reliability: With a high volume of transactions, ensuring the platform's stability (mentioned as a 99.7% stability index) and providing reliable performance is paramount for user trust and business continuity.

Research iterations & Discovery

To understand the pain points of the ecosystem, we worked with:

• Representatives from internal teams (finance, procurement, logistics)

• Potential suppliers to understand their current workflows

• Stakeholders at Nexxera to understand the strategic goals, business requirements, and key performance indicators (KPIs) for the Hubly platform

• Representatives from internal teams (finance, procurement, logistics)

• Potential suppliers to understand their current workflows

• Stakeholders at Nexxera to understand the strategic goals, business requirements, and key performance indicators (KPIs) for the Hubly platform

Key insights:

• Identification of Fragmented Processes: Businesses faced significant challenges due to disparate systems and manual processes in managing their financial and mercantile operations

• Pain Points in Supplier Management: Difficulties in managing relationships and communications with numerous suppliers across various channels

• Challenges in Financial Visibility and Control: Businesses struggled to gain a unified view of their financial health due to data being scattered across different banking portals and systems

• Need for Automation: A significant finding would have been the desire and need for automation of repetitive and manual tasks in areas like accounts payable, accounts receivable, and bank statement consolidation

• Importance of Supplier Self-Service: Research indicated a need to empower suppliers with self-service capabilities to access information, manage transactions, and resolve issues independently

• Identification of Fragmented Processes: Businesses faced significant challenges due to disparate systems and manual processes in managing their financial and mercantile operations

• Pain Points in Supplier Management: Difficulties in managing relationships and communications with numerous suppliers across various channels

• Challenges in Financial Visibility and Control: Businesses struggled to gain a unified view of their financial health due to data being scattered across different banking portals and systems

• Need for Automation: A significant finding would have been the desire and need for automation of repetitive and manual tasks in areas like accounts payable, accounts receivable, and bank statement consolidation

• Importance of Supplier Self-Service: Research indicated a need to empower suppliers with self-service capabilities to access information, manage transactions, and resolve issues independently

Design Process

As the Principal Product Designer, my workflow integrates the principles of Design Thinking within the Agile framework to ensure continuous delivery of user-centric and valuable solutions. Here’s a summary breakdown of my process:

• Sprint Planning & Discovery (Empathize & Define): Before each sprint, we plan and I ensure we understand user needs from a user perspective. This involves reviewing stakeholders' requests and collaborating with the Product Owner to define problems related to Hubly's unified financial and mercantile management, including supplier management, contracts, collections, and receivables. We aim to translate user needs into clear design challenges for Hubly.

• During the Sprint (Ideate, Prototype & Test): During sprints, I collaborate in ideation for Hubly features like the supplier portal and payment systems. I create prototypes (wireframes, mockups) to visualise solutions. Crucially, I conduct user testing to gather feedback and iterate on designs, ensuring Hubly is intuitive for managing financial and mercantile processes. We consider market standards for Brazilian interchangeable data files like CNAB formats.

• Sprint Review & Retrospective: At the end of each sprint, I participate in reviews to showcase designs and in retrospectives to improve and socialize our design process for Hubly.

This iterative approach ensures Hubly's design is user-centric, aligns with business goals, and continuously improves for managing financial and mercantile operations in a single platform. Hubly aims to automate processes and improve efficiency.

• Additional considerations regarding development: Based on the development team's performance, learning curve, and code optimization, the company's CTO decided that all internal products should use Google Material Design and REACT as the development framework.